Common types of gifts

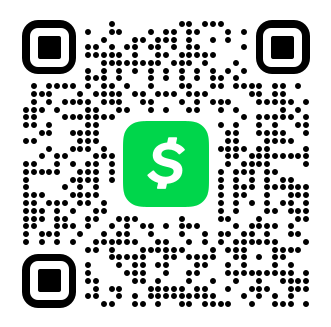

Cash Gifts

Currency, checks or money orders made payable to the Lowcountry Fund are common donations, as are credit card gifts.

IRA Charitable Rollover

If you have an IRA and you’ve reached age 72, you are required by the IRS to take annual Required Minimum Distributions (RMD). If you don’t need your IRA for income – and you would like to maximize your charitable giving while reducing your tax liability – you can transfer up to $100,000 per year directly from your IRA to the Lowcountry Fund without paying income tax on the transaction. If you file a joint tax return, your spouse can also make a charitable contribution of up to $100,000, meaning couples can exclude up to $200,000 from income tax if they donate it to charity.

Securities

Gifts of appreciated securities often allow you to make a substantial contribution while receiving valuable income tax advantages. Generally, a donor may deduct the fair market value of the gift up to 30% of their adjusted gross income with a five-year carryover for any excess when deductions are itemized. Most importantly, the capital gain from the donated asset passes tax free to the Community Foundation.

Real Estate

The Lowcountry Fund can accept personal residences, vacation homes, farms, commercial buildings and undeveloped land. Property owned for more than one year will qualify for a deduction based on the fair market value of the property and will avoid capital gains tax. Deductions are limited for real property that is subject to a mortgage or loan.

Life Insurance

A gift of life insurance is another way to make a substantial contribution. Transfer ownership to the Lowcountry Fund and receive a tax deduction for the policy’s cash value.

Planned Gifts

If you wish to leave a gift that costs nothing during your lifetime, consider including the Lowcountry Fund in your will or estate plan. Through a planned gift you can establish a gift with cash, property, a percentage of your estate or the remainder after distributions to other beneficiaries.

Deffered Gifts

When you include the Lowcountry Fund in your estate plan, you make a charitable gift, enjoy tax benefits, and preserve economic security for yourself and your family.

Other Gift Types

Additional gifting choices include stock in privately held companies, limited partnerships and company stock options, with the exclusion of employee stock options. Personal property and other assets may also be excellent contributions. Please contact the Development and Donor Services office for information regarding these gift opportunities.

Common types of donation

- Building Materials

- Tools

- Vehicles

- Non-Perishable Foods

- Toiletries

- School Supplies

- Medical Supplies

- Electronics

- Furniture

- Household Items

- Time

- Gift Cards

- Appliances

- Sports Equipment

Common types of donation

- Building Materials

- Tools

- Vehicles

- Non-Perishable Foods

- Toiletries

- School Supplies

- Medical Supplies

- Household Items

- Furniture

- Electronics

- Sports Equipment

- Appliances

- Gift Cards

- Time

Donate

Donate